Pricing

Flexible Packages, Transparent Pricing.

Trusted Advice.

Trusted Advice.

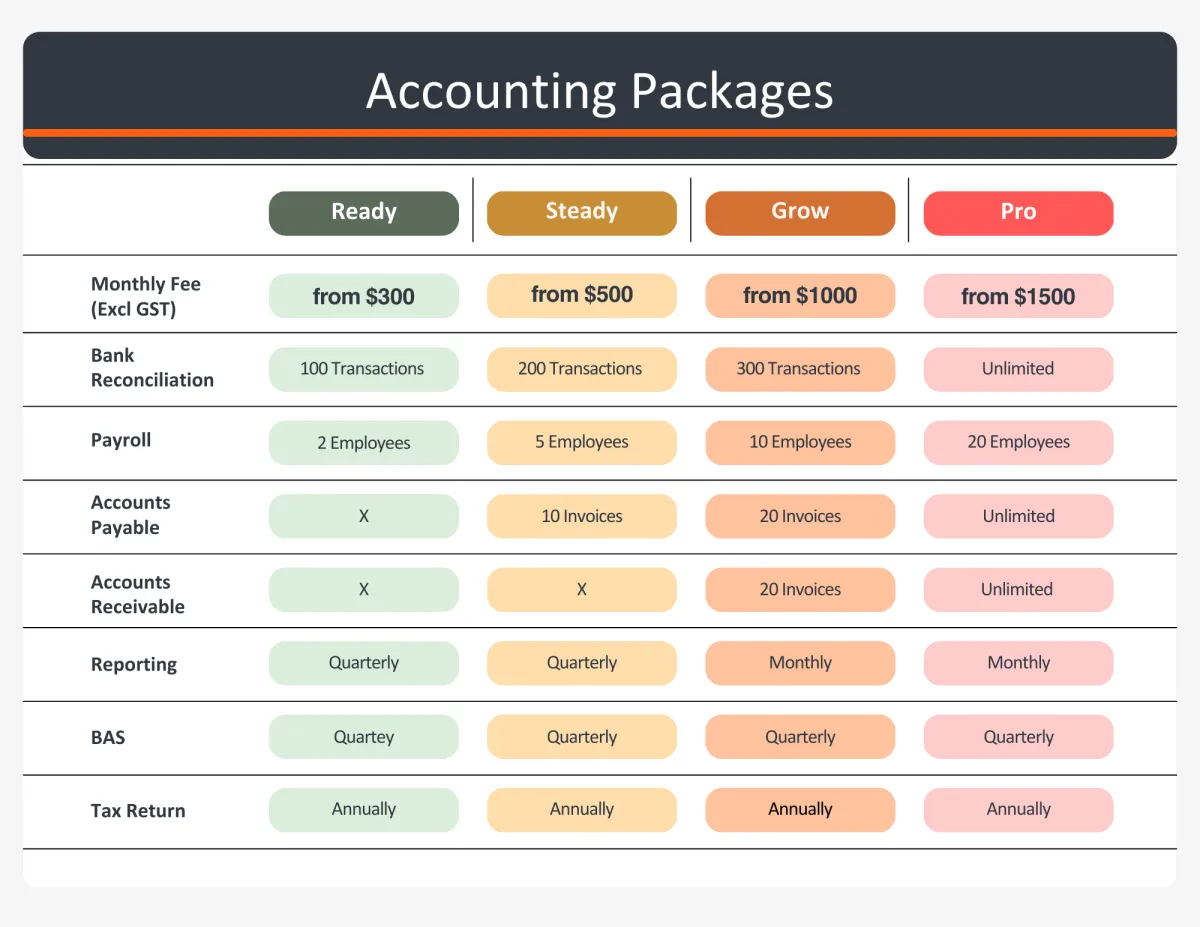

Ready

Monthly Fee (Excluding GST)

From $300

Bank Reconciliation 100 Transaction

Payroll 2 Employee

Accounts Payable X

Accounts Receivable X

Reporting Quarterly

BAS Quarterly

Tax Return Annually

Payroll 2 Employee

Accounts Payable X

Accounts Receivable X

Reporting Quarterly

BAS Quarterly

Tax Return Annually

Steady

Monthly Fee (Excluding GST)

From $500

Bank Reconciliation 200 Transaction

Payroll 5 Employee

Accounts Payable 10 Invoices

Accounts Receivable X

Reporting Quarterly

BAS Quarterly

Tax Return Annually

Payroll 5 Employee

Accounts Payable 10 Invoices

Accounts Receivable X

Reporting Quarterly

BAS Quarterly

Tax Return Annually

Grow

Monthly Fee (Excluding GST)

From $1000

Bank Reconciliation 300 Transaction

Payroll 10 Employee

Accounts Payable 20 invoices

Accounts Receivable 20 invoices

Reporting Monthly

BAS Quarterly

Tax Return Annually

Payroll 10 Employee

Accounts Payable 20 invoices

Accounts Receivable 20 invoices

Reporting Monthly

BAS Quarterly

Tax Return Annually

Pro

Monthly Fee (Excluding GST)

From $1500

Bank Reconciliation Unlimited

Payroll 20 Employee

Accounts Payable Unlimited

Accounts Receivable Unlimited

Reporting Monthly

BAS Quarterly

Tax Return Annually

Payroll 20 Employee

Accounts Payable Unlimited

Accounts Receivable Unlimited

Reporting Monthly

BAS Quarterly

Tax Return Annually

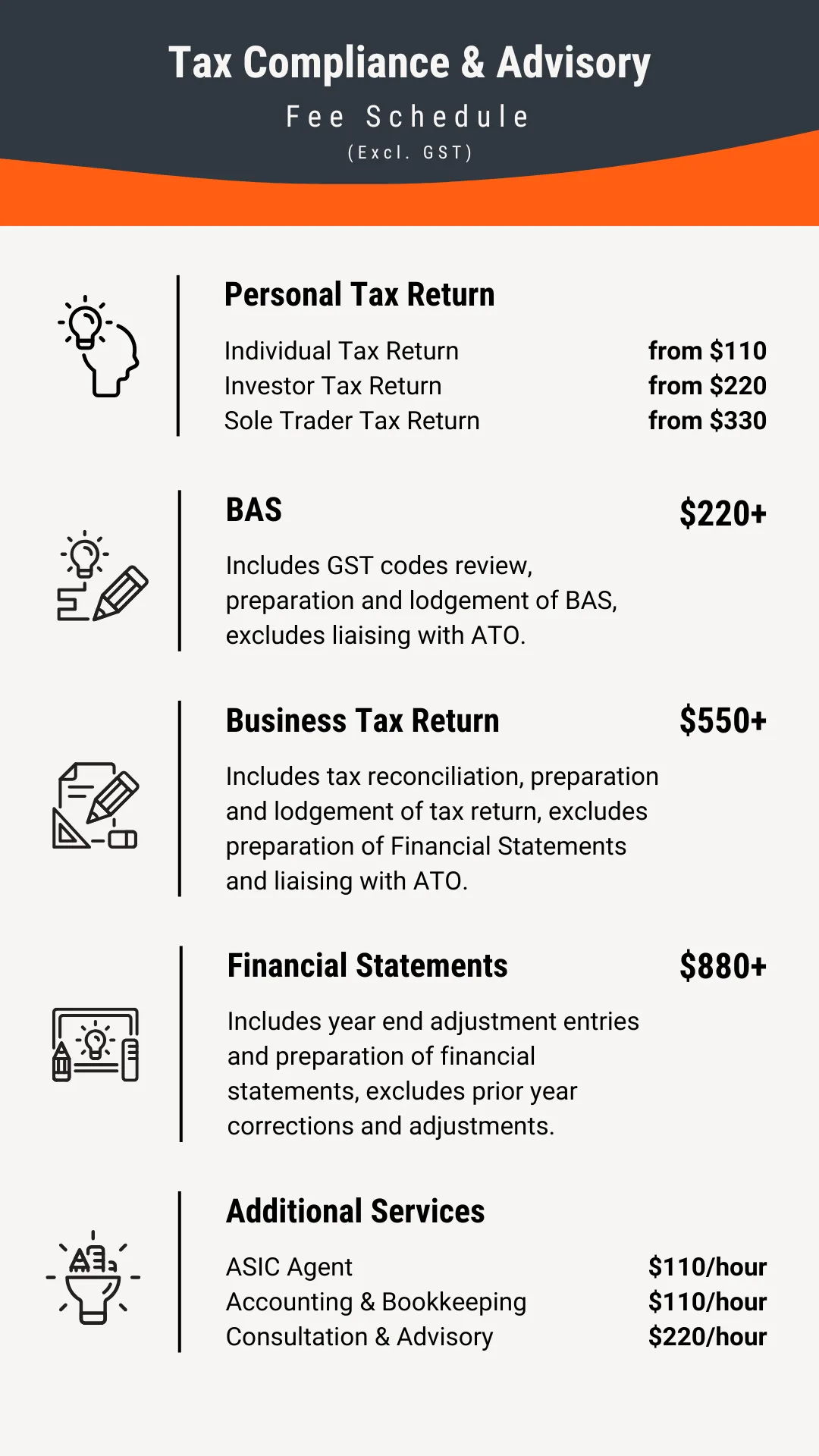

Personal Tax Return

From $110

Individual Tax Return from $110

Investor Tax Return from $220

Sole Trader Tax Return from $330

Investor Tax Return from $220

Sole Trader Tax Return from $330

Business Tax Return

From $550

Includes Tax reconciliation,

preparation and lodgement of Tax Return,

excludes preparation of Financial Statements.

preparation and lodgement of Tax Return,

excludes preparation of Financial Statements.

BAS

From $220

Includes GST codes review,

preparation and lodgement of BAS,

excludes liaising with ATO.

preparation and lodgement of BAS,

excludes liaising with ATO.

Financial Statement

From $880

Includes year end adjustment entries,

preparation of Financial Statements,

excludes prior year corrections and adjustments.

preparation of Financial Statements,

excludes prior year corrections and adjustments.

SMSF Compliance

From $2500

Includes basic Bookkeeping, Financial

Statements, Tax Return and annual Audit,

excludes SMSF and/or Bare Trust registration.

Statements, Tax Return and annual Audit,

excludes SMSF and/or Bare Trust registration.

Additional Services

From $110

ASIC Agent Services $110 per hour

Accounting & Bookkeeping Services $110 per hour

Consulting & Advisory Services $220 per hour

Accounting & Bookkeeping Services $110 per hour

Consulting & Advisory Services $220 per hour